The Impact Angel - Business Goes Green

Matt Jellicoe

is a technology entrepreneur and an angel investor in early stage companies. He is part of the Green Angel Syndicate group.

There is definitely a personal angle to my investments today. Over the last 12 months I have started switching my investment strategy away from pure technology and fintech and into companies with a ‘green’ angle or that focus on sustainable business practices, solving issues such as recycling and waste. The professional term for this kind of thing is ‘impact investment’. Ie investing for societal impact. In my case its more green impact investing. I’ve started with small investments into companies such as Polysolar - a great company that makes glass panels that generate electricity at very little extra cost relative to glass - imagine an office block that can power itself or a car port that can charge an electric car!

I feel much better aligning my business affairs with my internal thoughts on what the world actually needs. After years of pent up frustration in terms of where the environment was heading in terms of emissions, pollution, rubbish and plastic contamination….finally I was doing something about it in my own way. Quite quickly I felt that by getting involved in new companies that were trying to solve some of these problems things could really change. I’ve found impact investing to be incredibly motivating and have actually started to feel a lot more positive about the future of this planet because I am actively doing something about it.

Increasingly I’ve become more adventurous - investing money into a Sustainable Accelerator fund on Seedrs - that gives exposure to scores of sustainable start ups. I’ve started to look at potential fast growth food companies that are focused on plant based models and so on.

I’m a business man and be in no doubt I am looking for investment returns. I genuinely feel that customers are already voting with their feet. And where the consumers go, the money obviously goes. From a consumer perspective the latent demand for all things green outstrips supply. Any company that does not embrace this in the next 3-5 years is likely to have major problems as consumers start to switch to more sustainable products, suppliers and lifestyles. Look at the schools strikes across the globe, the media coverage on TV or polls such as Yougov on climate change. Recent research is underlining a huge growth in environmental awareness from consumers.

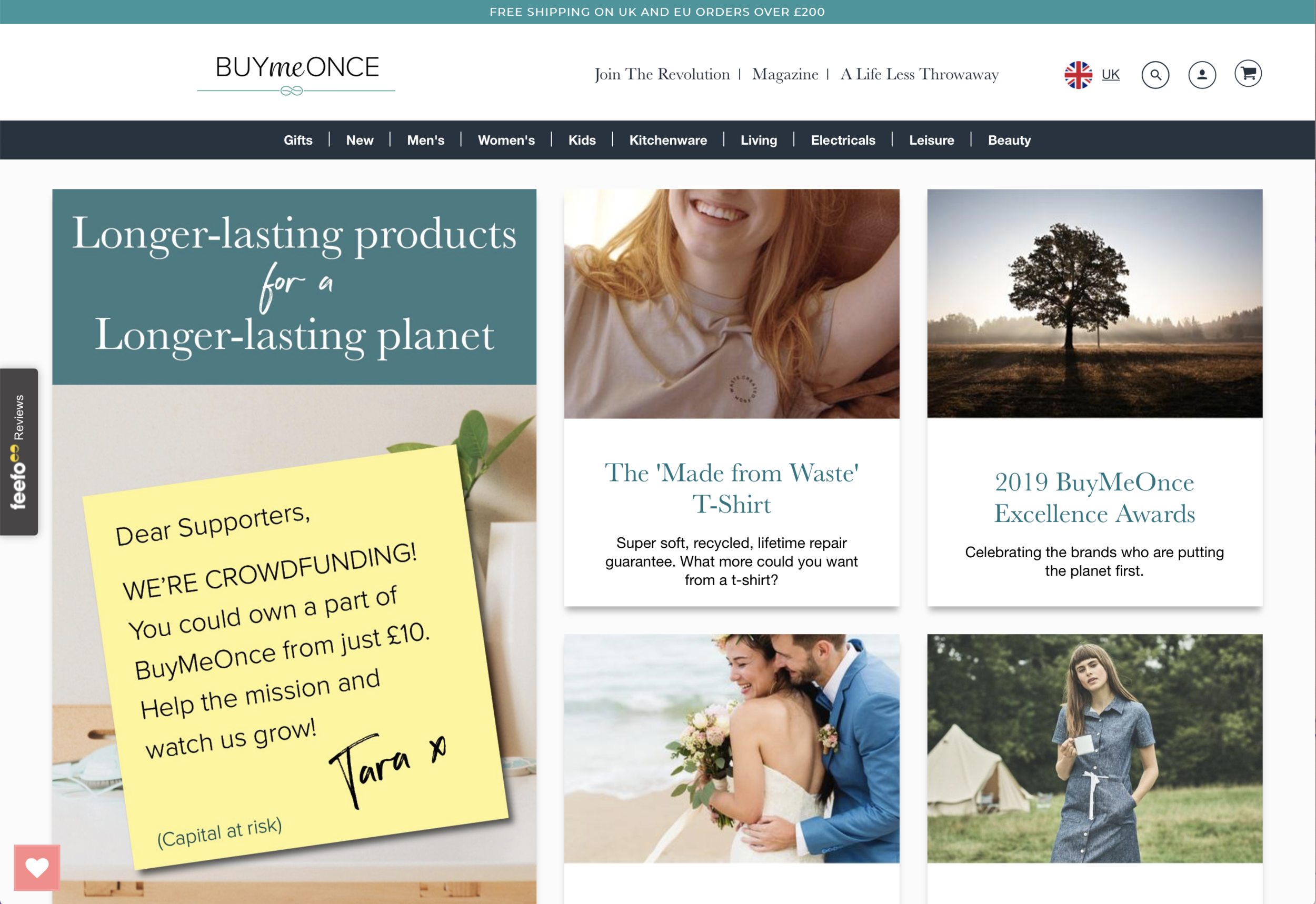

I recently invested in a company called Buymeonce. The premise of this online retailer is simple – they only sell products that will last a longtime (often a lifetime) with guarantees and aftercare and so on. However if you look at the consumer interest in this site – it’s huge; over 3m visitors since launch and 60,000 followers for a fledging e-commerce site.

According to the Ethical Consumer ethical consumer spending in the UK doubled between 2010 and 2018 from £40bn to £80bn per annum. Ethical food and drink consumption grew from £5bn to £11bn in this period and continues to grow at 16% per annum. Any businessman running any consumer facing company would be crazy not to be pivoting their business accordingly.

There has never been a better time to be an a green investor – there are so many resources out there to plug into if you wish to be an Impact Angel. For example I recently joined Green Angel Syndicate – an organisation chaired by Nick Lyth. This is an angel syndicate with over 100 angels who are from diverse backgrounds encompassing solar, wind energy, engineering and utilities provision. This syndicate provides an amazing entry point into early stage companies with a ‘green angle’ - it is a great start for an investor wanting to become more involved in sustainable impact investment.

The crowdfunding sites are starting to see a really good pipeline of sustainable businesses that are looking to change the way we live. I had a quick look on Crowdcube and as of today and 25% to 30% of the companies raising have a serious environmental impact element whether renewable energy, clothing or recycling/packaging. Investors are backing these companies and this is great news. The good thing about many of the sustainable consumer businesses that are raising via crowdfunding is that you can try them as a customer first. I recently invested into Goodclub for example – think of a zero waste delivery supermarket of sorts. This is a business that we as a family have been using for months – and we were delighted to be able to invest.

The bottom line is that I have come to a realisation that financial returns are no longer good enough as an investor. Looking at the number of investors and angels out there backing sustainable start ups I am part of a growing trend. There has to be societal return and environmental return. Capitalism needs to evolve and quickly. However this can be a very rewarding journey spiritually and I have no doubt financially.